PayG is that payment gateway that you simply decide for your e-commerce site should impart trust in your customers as they create their buys. In this way, incorporating a payment gateway to an e-commerce platform is popping into an important method to expand deals for every e-commerce store. It is a straightforward programming application. It’s fundamentally a channel between an e-commerce site and therefore the bank that supports a client’s card payment through the payment gateway providers. Eventually, a payment gateway is the last advance of the net sales process on an e-commerce site. Without it, you can’t have the choice to charge your clients after they purchase things from your website. At the purpose when clients visit your e-commerce store, they’re attempting to find an honest deal on a product or service and an easy and secure payment process

Payment Gateway is a web payment processing technology that helps businesses to just accept credit cards and electronic checks. In other words, payment gateways are man in-the-middle which is located between e-commerce platforms and clients. Here are the steps showing how payment gateway for e-commerce works

The customer visits a shopping website and places an order and clicks on the buy button. A message is sent to the website regarding the customer’s desire to buy and make payment

The Web store’s server, after receiving the message from the buyer, receives a message called a digital order, and also includes the consumer’s IP address and transaction amount. This order is now sent to the payment gateway over a secure network.

Based on the order, the payment gateway authenticates the web store.

The payment gateway offers various payment options to the buyer.

The buyer chooses the desired payment option for the transaction, which is transmitted via the secure link to the payment gateway.

Next, it sends the payment details to the bank

The bank sends the information to the buyer’s issuing bank or buyer’s bank over a secure link

Based on the credit limit, the issuing bank either accepts or rejects the transaction. The confirmation/rejection message is transmitted to the PG through the bank.

The payment gateway then transmits digital transactional receipts to the shopping site and the buyer.

The web store now can ship the goods or services to the buyer.

On the whole,using a PayG Virtual POS system to supplement your regular POS lets you increase your sales and build new customer relationships beyond the confines of your location, which in turn spurs growth and provides new opportunities to expand your business.

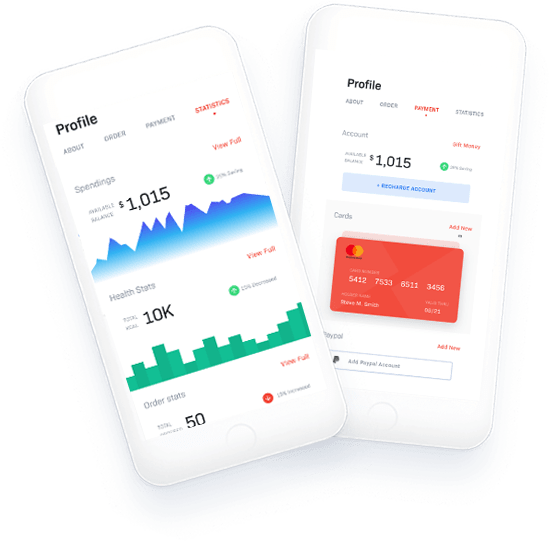

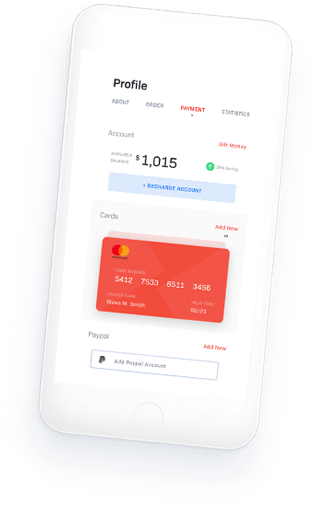

For Better Experiance download our app