Simplify your business efforts with UPI 2.0

UPI 2.O is a seamless solution for customers to set up recurring payments using their UPI app. Customers can e-mandate and timetable a foreordained date to cover a common tab with no danger. PayG has been effectively running after making a superior stage for rustic independent companies and people to locate their online presence towards the 'Digital India.'

UPI 2.0 targets tending to worries by giving more settings to the fundamental exchanges. Most UPI exchanges have been payer started and zeroed in on individual to-individual (P2P) moves.

The capacity of dealers to send an advanced receipt alongside a gather demand in UPI 2.0 can help the payer with the ultimate objective of the sales and lift gather demand side exchanges.

KEY FEATURES OF UPI 2.0

- One-time mandate

- Linking of overdraft account

- Invoice in the inbox

- Signed intent and QR

Taapping Use Cases

Small and Mid-sized Enterprise-Enhanced exchange limits esteem. Encourage budgetary exchange to gather membership and one-time payments by sharing solicitations for making payments.

E-commerce & M-commerce- Resolves the cash of delivery option. Seamless fund collection from customers single identifiers.

Micro merchants/Retail stores- Instant payment acceptance by scanning QR codes set up at grocery stores/retail outlet in rural areas to make transaction seamless

Rural area businesses- Milk centres, poultry farms, flour mills, wholesale market, oil mills, etc., can opt for UPI-based transaction and get benefitted immensely

Subscription services- Use autopay for pull-based collect requests for school/colleges fees, mobile phone bills, electricity bills, water bills, utility payments at regular interval

What is VPA

VPA stands for Virtual Payment Address like your email (eg. payg@bankname). A VPA can be connected to any financial bank account.

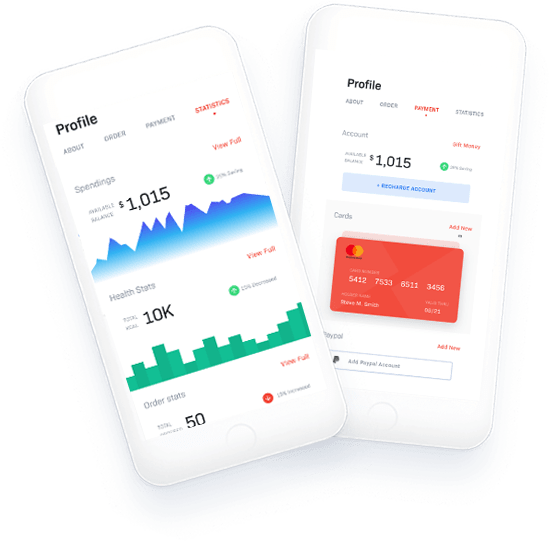

UPI across platforms

UPI can be used across different platforms and it can work crosswise over web and mobile. It is additionally supported on PayG's current Android SDK tools.

How one can make a VPA

VPA can be made from a UPI enabled bank mobile app or the third-party app.

What makes UPI a protected platform

This interface depends on the 2-Factor Authentication with a consistent single click payment. This element of UPI is lined up with the administrative rules that make it the most secure. 2-Factor Authentication is very like OTP. Here, MPIN will be utilized rather than OTP.