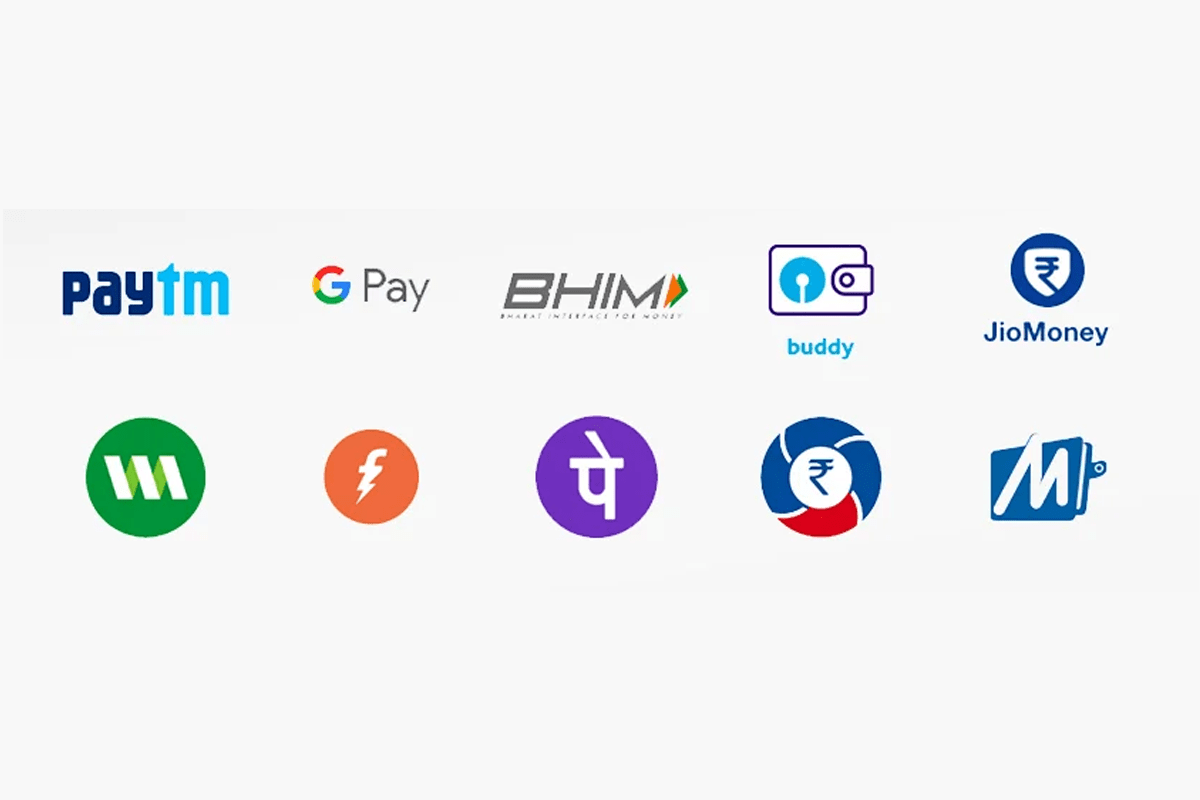

Get UPI payments through GooglePay, BHIM, WhatsApp, and so forth. Receive payments by means of UPI without the problem of taking care of SMS notifications or recalling your VPA. You can just make the use of applications like PhonePe, WhatsApp, BHIM and so forth to directly receive payments.

UPI stands for Unified Payments Interface which is a quick constant payment framework that helps in immediately transfer the funds in between the two bank accounts through mobile. Much the same as Credit and Debit cards, UPI is another payment alternative. It abstracts your financial details as a VPA. And rather than sharing complex account details, the client can simply share the VPA to accept/send cash. And also in real-time! Thus, UPI is an idea that permits various bank accounts to get into a single mobile application. This thought was produced by the NPC that is National Payments Corporation of India and is controlled by the RBI that is Reserve Bank of India and IBA (Indian Bank Association).

VPA stands for Virtual Payment Address like your email (eg. payg@bankname). A VPA can be connected to any financial bank account.

UPI can be used across different platforms and it can work crosswise over web and mobile. It is additionally supported on PayG's current Android SDK tools.

VPA can be made from a UPI enabled bank mobile app or the third-party app.

This interface depends on the 2-Factor Authentication with a consistent single click payment. This element of UPI is lined up with the administrative rules that make it the most secure. 2-Factor Authentication is very like OTP. Here, MPIN will be utilized rather than OTP.

Virtual POS is another easy purpose of the offer and showcasing solutions worked to enable dealers to develop and deal with their organizations more than ever and is a part of PayG now.

For Better Experiance download our app