In India, the payment and settlement systems are regulated by the Payment and Settlement Systems Act, 2007 (PSS Act) which was legislated in December 2007. The PSS Act as well as the Payment and Settlement System Regulations, 2008 framed thereunder came into effect from August 12, 2008. In terms of Section 4 of the PSS Act, no person other than the Reserve Bank of India (RBI) can commence or operate a payment system in India unless authorised by RBI.

The Reserve Bank has taken numerous activities towards presenting and updating sheltered and effective methods of payment frameworks in the nation to meet the necessities of the general population on the loose. The prevailing aspects of enormous geographic spread of the nation and the tremendous system of parts of the Indian financial framework require the coordination of assortment and conveyance of paper instruments. These parts of the financial structure in the nation have consistently been remembered while building up the payment frameworks.

Oversight of the payment and settlement frameworks is a national bank work whereby the destinations of wellbeing and productivity are advanced by checking existing and arranged frameworks, evaluating them against these goals and, where important, inciting change. By regulating payment and settlement frameworks, national banks help to keep up fundamental security and diminish foundational hazard, and to keep up open trust in payment and settlement frameworks.

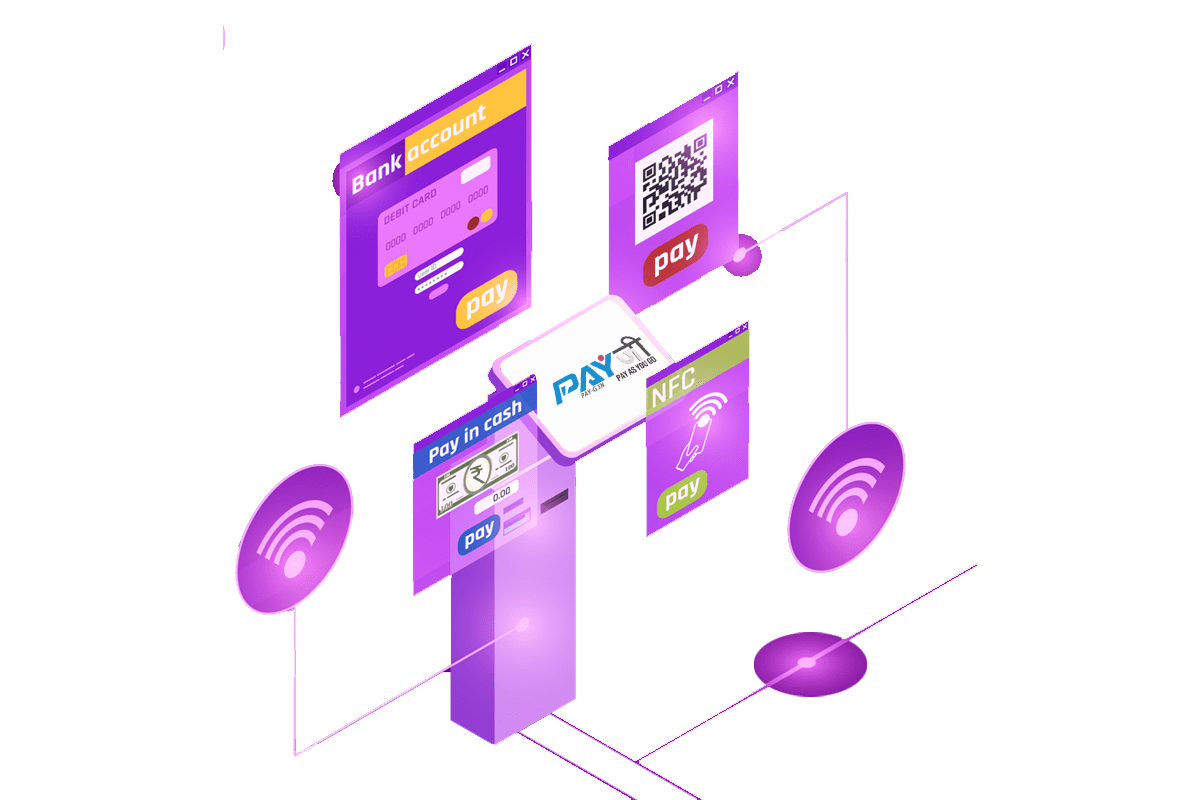

Get access to the most widely adopted digital wallets, including Apple Pay, Google Pay, Samsung Pay, Visa Checkout, and more

Go global but be local -- easily offer the most relevant local payment types to your customers.

Virtual POS is another easy purpose of the offer and showcasing solutions worked to enable dealers to develop and deal with their organizations more than ever and is a part of PayG now.

For Better Experiance download our app