Like every other day, I was scrolling through my Instagram Feed, when an ad with a picture of a wooden chest caught my eyes. It was a beautiful piece of art with wooden engravings all over and also the engravings could be personalized. It did not even take me any further to decide to buy it for the corner of my room beside the plants.

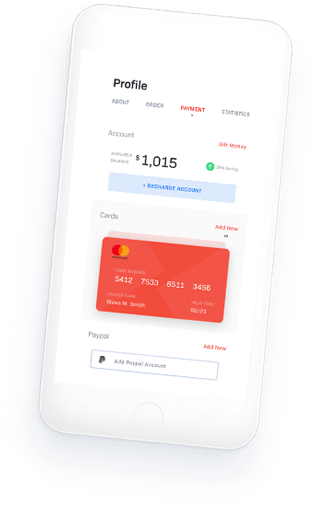

This will help associations with understanding what settlements are, the place where they can check their settlements status on the PayG dashboard and how to oblige settlements.

So, there I was, I went to the page, it said DM for the price, well I did the same. The chest costed 23,920 Indian Rupees. Now I was too eager to buy the chest, so I enquired about the process further, and they asked me to text my address and to pay via UPI. When I asked for an Invoice, I got to know that they do not provide any invoice and do not have any system in place to track their orders, it was an informal setup they were working in, with Products which did not cost any less. Now as a customer I was in dilemma to trust these people or not. As a company with no website and even a payment gateway who would have verified the company before integration, I came to a conclusion to leave the product and get onto other sites, to find the same product.

However, the product was specific to that company and did depict the talent of exceptionally skilled workers employed there.

The day, I realized the importance of the systems in place in the Payment industry. If only the page had a payment gateway integrated with them, I would have trusted that at least the company is verified and exists. I also would have an invoice in hand and a Compliant Gateway to go to in case I face any issues later on.

Usually the start-ups in India, come up initially with a brilliant piece of Idea or a product. However, with time their growth sunk, because the execution never takes place as it should be. Number of Promotions and marketing fail if the start- up is not verified and do not have a payment system integrated since it gives an idea of a naive company.

How Payment Gateways Serve An Important Purpose To Start-ups

A payment gateway is the first setup in the structurization of a company. When payment methods are sorted with a customer’s perspective, the company can start putting the other pieces in place.

With or without website, with no integration cost as offered by many Payment Gateways, the start-ups can start selling their products in a formal way. A Gateway verified start-up is an add on to build trust with the customers.

A Payment Gateway, like PayG, apart from providing all the digital modes of payment (CC/DC/NetBanking/Wallet/UPI) also provides Reporting tools to track the direction of your growth.

The start-ups can easily on fingers track the incoming and outgoing cash flow in statistical formats.

After the integration, they can concentrate on the other areas of the company, as they can be rest assured that their payment system and tracking is taken care of.

The transaction settlements and Taxes are a Gateway’s segment, no more banking visits saves a lot of time which any individual starting out a company lacks. The Payment Gateway’s also provide a feature of Payouts, which basically is paying out their employees, vendors and returns to customers maintaining privacy by using a virtual account number.

With every update on the payment systems digitally, the gateway handholds the users through the process and explain the best possible ways to use the features. A gateway allows the start-ups to even constrict their payment system as per their needs and target customers.

Now with the Recurring payments in place, the customers who prefer COD could be a offered a Pre scheduled COD, which would still work digitally however the money would be deducted after the product delivery, improving customer satisfaction.

Split Payments is another feature which serves the accounting department. It gives an automated calculation of the money to be paid to vendors, Delivery team and others equally and unequally.

When it comes to PayG, apart from these, it specializes with 2 other products extending its features, Easy collect and Collecting order, the first which helps the start-ups or users to generate links in bulk for multiple customers with customizable amount and other parameters, saving one from generating links one at a time for each customer.

With Collecting order, the users can generate a links with a catalogue mentioning specific charges.

This could be better understood as a menu card with specific prices for specific products/services,

Collecting Order incorporates the same as a service catalogue which is created by the user/Start-ups for their various services and products and the end customer would be selecting the services bought and would pay. Every other parameter is Customizable in ways which can serve the user better.

The links also are generated with allowing partial payments, which are best suitable for events and donations.

The start-ups who do not prefer investing in a website initially, can always integrate the payment systems to their social media pages via payment buttons which again serves the purpose.

The Payouts also come with a bulk payment feature along with the individual payments, one at a time.

The user can always handover the Dashboard tool to a beginner also, if required with a constricted access.

When it comes to PayG, apart from the above features, it also helps the merchant to establish its own online store with its POS functionality. Enter the product details, pricing other basic details and the user have their own online store.

Also, PayG satisfies the highest security standards by being compliant with the Payment Card Industry Data Security Standard (PCI-DSS). The initiation of PayG product features is based on the lines of Security. Security is significant when taking payments on the web, for the wellbeing of the two players. Payment gateways must conform to the Payment Card Industry Data Security Standard (PCI DSS), which specifies that all card information must be put away and prepared in a safe situation.

This implies you ought to pick a PG with an elevated level of encryption to guard client information. Matching a PG with a coordinated facilitated payment page is the most ideal approach to guarantee you are PCI consistent.

In these times, integrating a gateway is a basic need, because the world is only going to get ahead on digital payments and so, will be the customers. All a start-up need is to come forward and build their own brand and get a recognition, and all through with a payment gateway in place acting as a growth base.

Are you an entrepreneur? What are your thoughts? Please let us know in Comments.