PayG is the quickest and simplest approach to dispense advances, acknowledge stores and gather reimbursements for new-age lenders. Recently, there's a spurt within the market participants, including Non-Banking Financial Companies (NBFCs), who have availed the license for providing payment wallet services under the governing laws and provisions. NBFCs are authorized to issue closed and semi-closed systems including mobile-based pre-paid instruments.

NBFCs are licensed entities that give differing kinds of loans to consumers and corporations. Thousands of NBFCs give differing kinds of loans with or without collateral. Payments for the NBFC sector is comparable to it of mutual funds and insurance with a small degree of variation in terms of charges, payment modes allowed and the way failed mandate debts are treated. NBFCs are on the rise as more and more loans are disbursed to individuals and corporations.

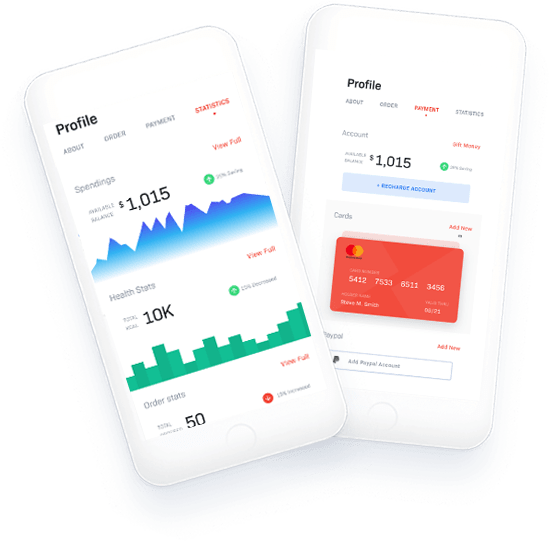

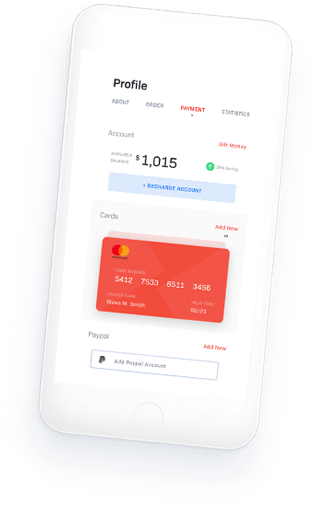

PayG helps you automate loan disbursals and repayment collection. Our solutions fit perfectly in your loan management system and you can have the benefit of advanced APIs and a spread of integrations and offer a superb user experience.

On the whole,using a PayG Virtual POS system to supplement your regular POS lets you increase your sales and build new customer relationships beyond the confines of your location, which in turn spurs growth and provides new opportunities to expand your business.

For Better Experiance download our app