PayG understands the necessities and challenges of payment processing within the public sector including public sector undertakings, government department’s ministries and municipalities. Our solutions are designed to exactly integrate at the executive level, ensuring seamless, easy and accurate payment processing. We help public sector automate their payment management systems, reducing costs and vastly improving processing accuracy and efficiency. Our vast experience within the payments vertical is great, which ensures success and satisfaction to our clients in public sector and government and their different undertakings.

PayG is a very cost-effective solution for the general public sector organization because there are not any hidden fees or setup costs. It allows you to gather payments on a monthly basis or one-time payment basis for various taxes and charges, including: vehicle tax, light-vehicle tax, fixed land tax, individual business tax, water charge, application fee, and facility charge. This service results in cost reduction and improvement of collecting rate. We provide payment processing, tracking, monitoring, accounting, reconciliation and reporting. PayG handles one-time payments, lump-sum payments and recurring payments. It is suitable for irregular payments of electronic application fee, facility fee, hometown tax, etc. Also, suitable for payments made once / several times in a year, such as payments of light-vehicle tax, vehicle tax, etc.

On the whole,using a PayG Virtual POS system to supplement your regular POS lets you increase your sales and build new customer relationships beyond the confines of your location, which in turn spurs growth and provides new opportunities to expand your business.

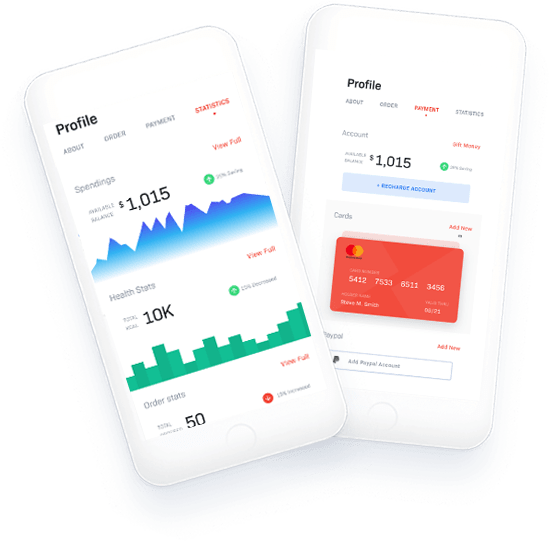

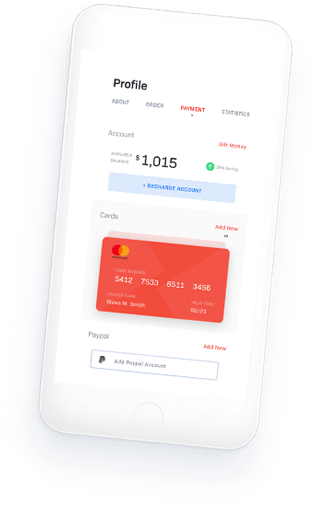

For Better Experiance download our app